- Support Center

- MyCast&Crew U.S.

- Loan-outs

MyCast&Crew: Update or Add Loan-Out Information

If you are an employee paid by Cast & Crew or CAPS, you can add your loan-out information directly in your MyCast&Crew portal.

Please note: While you can add and manage your loan-out details in your portal, this does not guarantee you will be paid as one. Please contact your production company if you have any questions.

- Log in to MyCast&Crew. If you don't have an account, you can register for one. Click here to learn how.

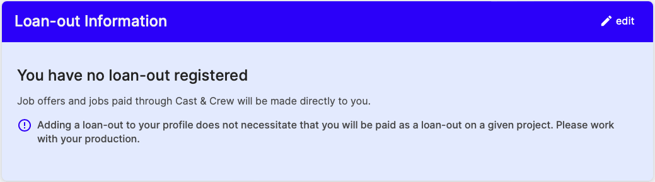

- On the dashboard, click the Loan-out tab in the top navigation bar.

- Click

edit to add or update your information.

edit to add or update your information.

- Follow the steps on the screen to verify your identity.

- Once your identity has been successfully verified, head back to MyCast&Crew and complete your loan-out verification on the form by:

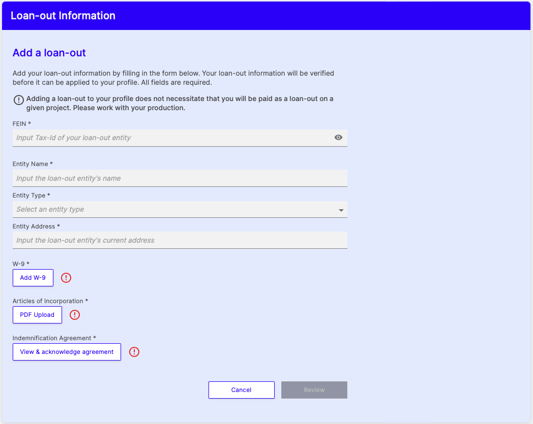

- Filling out the required loan-out fields (all fields are required)

- Filling out and adding the W-9 form

- Uploading proper documents for LLC loan-outs

- For single or multi-member LLCs, we require the IRS Acceptance Letter

- For partnerships, we require a Redacted Form 1065 tax return OR a Partnership Agreement

- Agreeing to the Letter of Indemnification (LOI)

- After you've completed all required information, click Review.

- Review your loan-out information.

- Click Verify.

Note: In some cases, an LLC entity may fail the loan-out registration process in MyCast&Crew if a business is not "active" with the Secretary of State (SoS), if they’re not in good standing with the SoS, are not authorized to act on behalf of the entity, or if the incorrect document is uploaded. Cast & Crew will not be able to pay them as a loan-out. In those cases, the crew member will need to reject their Start+ offer and request a W-2 offer to be sent or correct their entity standing with the SoS and try to verify again,

If the wrong document is uploaded, the crew member will need to reregister their loan-out and upload the appropriate document to be verified again.