- Support Center

- PSL+

- 1099/T4A Generating and User Guides

PSL+: Creating an IRS eFile

Creating an IRS eFile

Before creating your IRS eFile, first complete Step A (Verify accuracy of company information), then:

- Determine if you are required to eFile by visiting https://www.irs.gov/

- If you have engaged Cast & Crew to eFile with the IRS on your behalf, contact PSL1099@castandcrew.com for your TCC (Transmitter Control Code)

- If you will be eFiling yourself, locate your TCC from your company’s tax professional

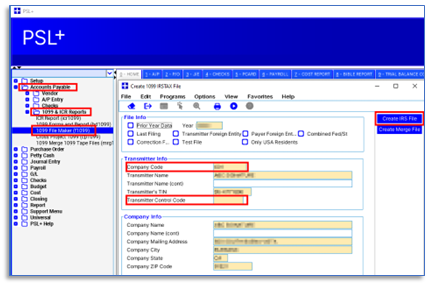

- Open Accounts Payable > 1099 & ICR Reports > 1099 File Maker

- Select your Company Code and other sections will auto-fill

- Complete fields that have not auto-filled, including your TCC in the Transmitter Control Code field

- Click Create IRS File and save to your desktop or other accessible location

- Submit your eFile:

- If you engaged Cast & Crew to eFile with the IRS on your behalf, review the directions at 1099 Print and eFile Services or contact PSL1099@castandcrew.com and ask for instructions

- If your company is eFiling directly to the IRS via their FIRE system, see the next section below

eFiling Directly With the IRS

The IRS uses the FIRE system (Filing Information Returns Electronically) for accepting eFiles, including 1099 reports.

Here are some important tips for eFiling with the IRS:

- Determine if you are required to eFile with the IRS: https://www.irs.gov/

- Ask your company’s tax professional for your TCC (Transmitter Control Code); if your company does not have a TCC yet, follow the directions for applying for a TCC from the IRS: https://www.irs.gov/