- Support Center

- PSL+

- 1099/T4A Generating and User Guides

PSL+: Codes for NEC 1099 and MISC 1099 Forms

Find help filling out the NEC 1099 and MISC 1099 Forms in PSL+

Jump to a section in this guide

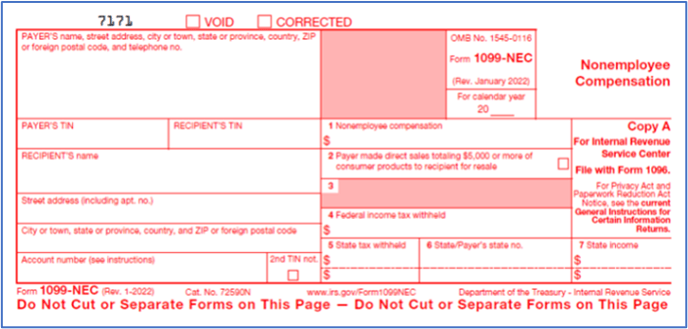

NEC 1099 Form

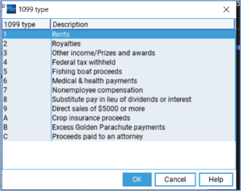

| NEC 1099 Form | PSL Code | ||

| Box | Description | Code to use in PSL+ | Description |

| 1 | Nonemployee compensation | 7 | Nonemployee compensation |

| 2 | Payer made direct sales totaling $5,000 or more... | not supported | Not related to our Industry |

| 3 | Blank | ||

| 4 | Federal Income tax withheld | not supported | Not related to our Industry |

| 5 | State tax withheld | not supported | Not related to our Industry |

| 6 |

State/Payer's state no. |

not supported |

Not related to our Industry |

| 7 |

State Income |

State Income (Calculated) |

|

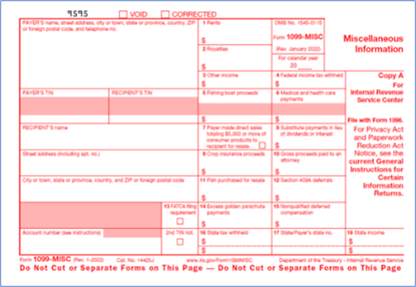

MISC 1099 Form

| MISC 1099 Form | PSL+ Codes | ||

| Box | Description | Code to use in PSL+ | Description |

| 1 | Rents | 1 | Rents |

| 2 | Royalties | 2 | Royalties |

| 3 | Other Income | 3 | Other Income/Prizes and awards |

| 4 | Federal Income Tax Withheld | 4 | Federal tax withheld |

| 5 | Fishing Boat Proceeds | 5 | Fishing boat proceeds |

| 6 | Medical and health care payments | 6 | Medical & health payments |

| 7 | Payer made direct sales totaling $5,000 | 9 | Direct sales of $5,000 |

| 8 | Substitute payments in lieu of dividends or interest | 8 | Substitute pay in lieu of dividends or interest |

| 9 | Crop Insurance Proceeds | A | Crop insurance proceeds |

| 10 | Gross proceeds paid to an attorney | C | Proceeds paid to an attorney |

| 11 | Fish purchased for resale | not supported | Not related to our Industry |

| 12 | Section 409A deferrals | not supported | Not related to our Industry |

| 13 | FATCA filing requirement | not supported | Not related to our Industry |

| 14 | Excess golden parachute payments | B | Excess Golden Parachute payments |

| 15 | Nonqualified deferred compensation | not supported | Not related to our Industry |

| 16 | State tax withheld | not supported | Not related to our Industry |

| 17 | State/Payer's state no. | not supported | Not related to our Industry |

| 18 | State Income | State Income (Calculated) | |