Jump to a section in this guide:

Reconcile Bank Statement [ckrbs]

Selection Criteria needed to process the Bank Reconciliation

Pre-Reconciliation

- Obtain monthly bank statements for reference.

- Confirm all transactions within the statement date range are status "PAID" which will ensure the payment appears on the Bank Reconciliation.

- Service charges, interest earned, and funding items must be entered in through the Journal Entry screen.

Reconcile Bank Statement [ckrbs]

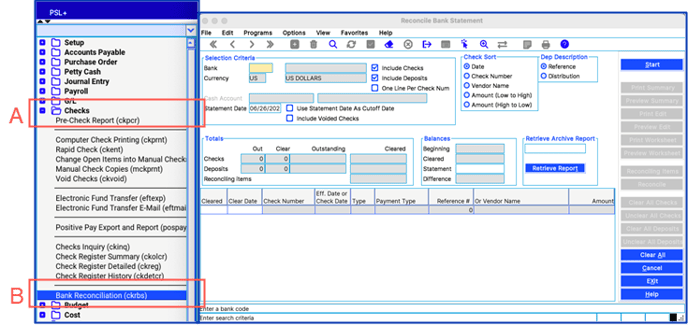

- Open ‘Checks’ (A) Menu -> select ‘Bank Reconciliation’ – [ckrbs]’ (B)

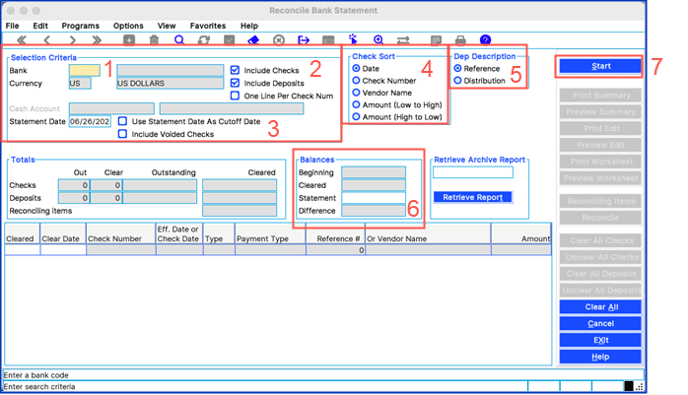

Selection Criteria needed to process the Bank Reconciliation

- Bank > Right click to select the bank.

- Include/ Exclude:

- Checks/Deposits > both are automatically selected by default.

- One Line per Check Number: will combine multiple invoices paid on the same manual check onto one line.

- Statement Date > enter the bank statement end-date. This will be the default cleared date of the items being reconciled.

USE STATEMENT DATE AS CUTOFF DATE -> By checking here: Checks and Deposits (Journals) with an effective date after the Statement End Date will not appear on the Bank Reconciliation. - Check Sort by > Choose sorting option. ‘Date’, most used.

- Dep Description option > ‘Reference’ description, most used.

- Balances

- Beginning (opening) balance > Confirm amount. Should match the ending (closing) balance of the previous statement.

- Statement balance -> Enter bank statement ending (closing) balance for the month being reconciled.

- Cleared and Difference -> are auto generated.

- Criteria is finalized, you are ready to begin: Click ‘Start.’

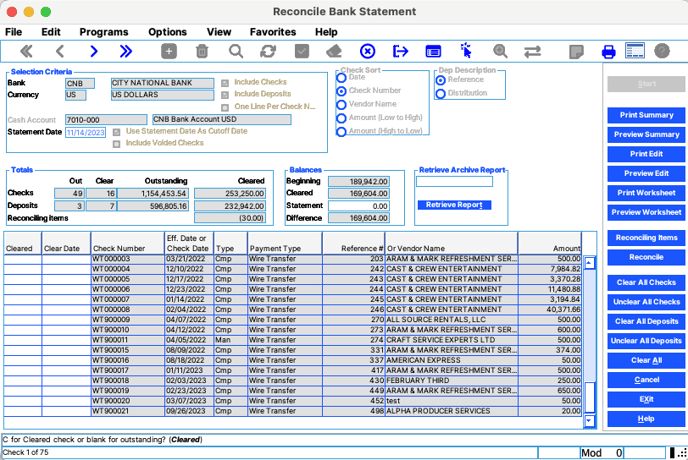

Reconciling Items

Once all the itemized checks and deposits populate, you can begin updating the “Cleared” status and “Clear Date”:

- To mark an item as ‘Cleared’ enter the letter ‘C’ > Change the ‘Cleared Date’, if needed.

- Once all items are cleared; Preview the Edit List: Print/Preview.

- Review statement and check book balance. Your bank statement is reconciled when the statement balance equals the checkbook balance.

- Post the Bank Reconciliation by clicking on ‘Reconcile’ > a report and pop-up window will appear confirming the report printed correctly > if you are ready to post the Bank Reconciliation, select ‘Yes.’

Additional Features

Reconciling Items

‘Reconciling Items' is a screen that allows you to input the description and amount of an item(s) in the event the Bank Reconciliation does not balance. This option can serve as a placeholder for statement differences. You can delete the reconciling item(s) once the items are recorded and cleared in PSL+.

** Contact PSL+ Support if you would like this option deactivated**

Retrieve Archive Report

This option serves as the archive retrieval. If you need a copy of past posted bank reconciliation reports, they are archived on our server for a limited time. You can check for all available posting registers here.

- Right-click in the “Retrieve Archive Report” field.

- All available reports will display.

- Choose the report you wish to save.

- Finally, click “Retrieve Report."